Medicaid customers are stressed about the eligibility changes

On April 1, the health insurance industry, and its customers experienced a seismic shift in coverage options as pandemic-era Medicaid enrollment expansions expired. The federal government estimates that nearly 15 million people will lose Medicaid coverage as a result.

With such a substantial change, DISQO used its industry-leading CX platform to understand how Medicaid beneficiaries felt the change impacted their customer experience (CX) and how they plan to cope with it. We learned that awareness of the change is low and, even after being informed, willingness to opt into private plans among impacted consumers was also low.

While our findings point to an opportunity for private insurers to reach new customers, they also reveal that customers won’t be easy to win over. These insights offer insurance providers a critical view of prospective customer needs and concerns, and can be used to design a thoughtful experience during what promises to be a stressful time.

Highlights

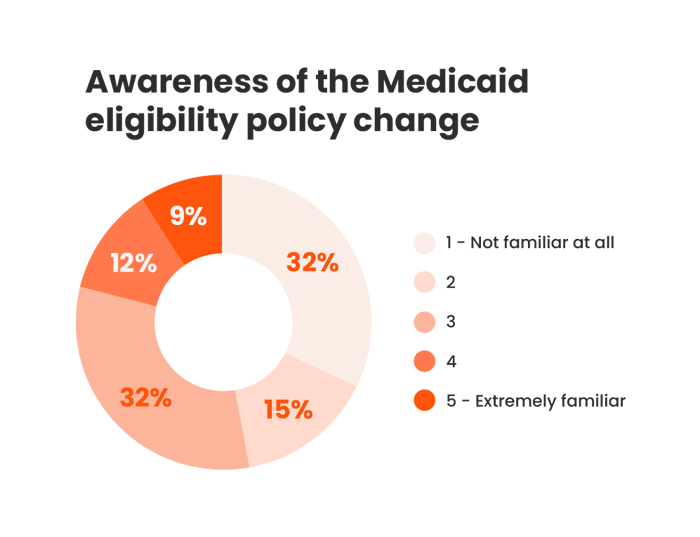

- While most Medicaid customers were unfamiliar with the upcoming policy change, after being informed, almost half believed they might lose their coverage.

- About a third who thought they might lose coverage cited income change as the main reason for potential ineligibility.

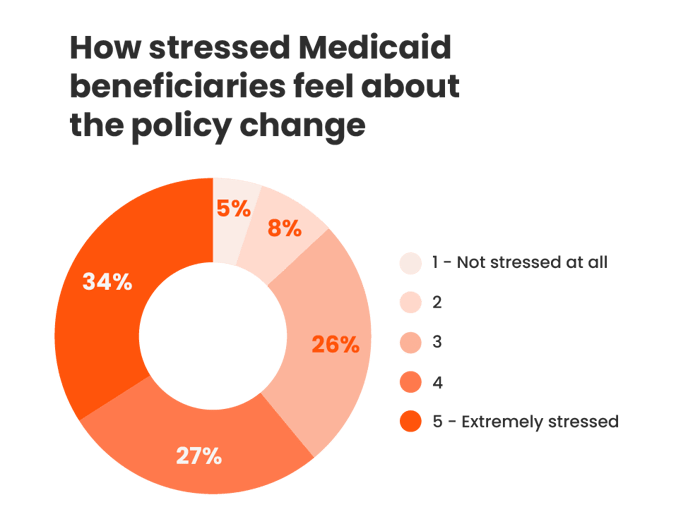

- The majority of Medicaid customers reported being very stressed or extremely stressed about possibly losing their coverage.

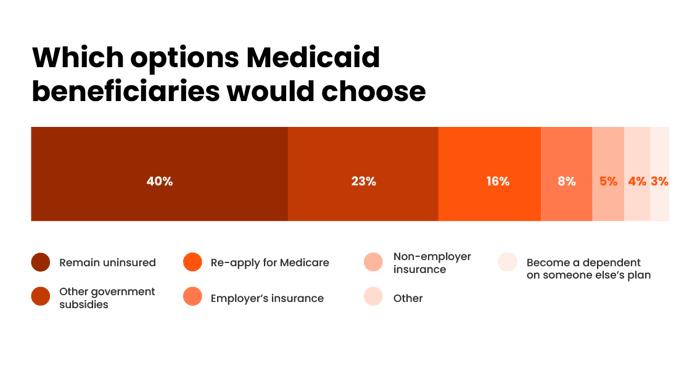

- Two-fifths reported that they would likely remain uninsured if they lost coverage.

Most Medicaid customers were unaware of the policy change

Source: DISQO Experience Suite, Medicaid beneficiaries, N = 1,892; March 7, 2023

Medicaid customers are using their benefits

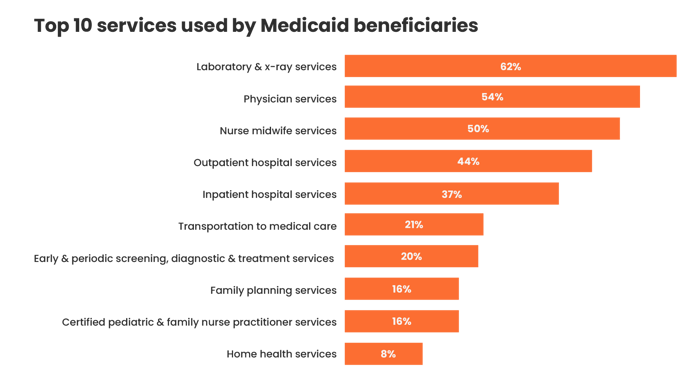

When asked what mandatory Medicaid benefits they have used while being enrolled, 62% of Medicaid customers selected laboratories and X-ray services, 54% selected physician services, 44% selected outpatient hospital services, and 37% selected inpatient hospital services. In addition, 69% reported paying no copayments monthly.

Source: DISQO Experience Suite, Medicaid beneficiaries, N = 1,892; March 7, 2023

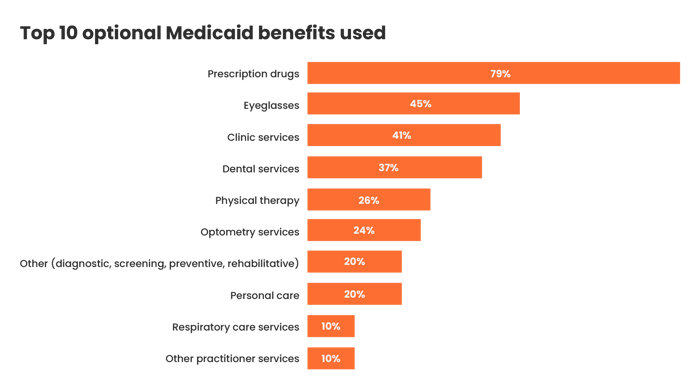

Similarly, customers reported high usage of optional Medicaid benefits, including prescription drugs (79%), eyeglasses (45%), clinic services (41%), and dental services (37%).

Source: DISQO Experience Suite, Medicaid beneficiaries, N = 1,892; March 7, 2023

Source: DISQO Experience Suite, Medicaid beneficiaries, N = 1,892; March 7, 2023

Nearly half of Medicaid customers think they may lose coverage

When asked if they were likely to lose coverage due to the policy change, 47% reported that there was a chance that they would lose coverage. One-third believed that they were at least somewhat likely to lose it. Retired customers and those aged 65+ selected “not likely at all” more frequently than others. Of those who believed they might lose their coverage, 31% cited “I earn too much” to be the reason, which corroborates the estimation by the Federal government.

Sixty-one percent of Medicaid customers who believed they might lose coverage reported feeling extremely or very stressed about it. In addition to the financial strain, they shared that losing access to healthcare such as routine checkups, having to delay seeking treatment, and being unable to afford prescription drugs, caused additional stress.

“I will start having to go to the free clinic in a neighboring city instead of going to my usual primary care physician, which I will no longer be able to afford. I will have to put off necessary hernia surgery as I will not be able to pay for it. I will have to not get any necessary prescription medicines in the future.”

- Male, 62 years old, Virginia

Source: DISQO Experience Suite, Medicaid beneficiaries, N = 1,892; March 7, 2023

Newly uninsured will need convincing to opt into private healthcare plans

When asked what their alternative choices would be over the next 12 months, 40% of customers reported that they would likely remain uninsured, while 39% would either apply for Medicare or other government subsidies.

Source: DISQO Experience Suite, Medicaid beneficiaries, N = 1,892; March 7, 2023

Private insurers have an opportunity to win over new customers, but it won’t be easy. Those that address consumer concerns head-on, offer accessible, affordable options, and provide a seamless onboarding experience will stand out.

Understand every health insurance customer with the DISQO CX platform

The DISQO CX platform has solutions for insurers looking to test, measure, and iterate on their customer experience. Whether you’re looking to assess new plan offerings , evaluate messaging resonance , track sentiment , or measure advertising brand and outcomes lift , we can help.

Methodology

Using the DISQO CX platform, we conducted an online survey of 1,892 Medicaid beneficiaries aged 18-75 (Mean age=44.9) about their attitudes regarding the policy change to uncover how beneficiaries perceive the eligibility verification. Questions addressed their use of current benefits, co-payments, coverage eligibility due to the policy change, alternative healthcare options, and more.

Subscribe now!

Get our new reports, case studies, podcasts, articles and events