Ad-supported streaming TV

In the fall of 2022, both Netflix and Disney+ are introducing ad-supported tiers to their streaming video services, with Apple TV likely to follow in early 2023. Needless to say, these introductions are hugely important for brands looking to connect with previously untapped audiences. Consumer reaction will have a lasting impact on how ad-supported streaming continues to evolve going forward and the success of advertisers who choose to leverage this new media opportunity.

To better understand what consumers think about ad-supported streaming, we recently surveyed over 30,000 consumers within our DISQO member community. The results suggest that ad-supported streaming introductions will be positively received by a majority of consumers, and will drive a substantial portion of non-subscribers to try out the lower-priced ad-supported tiers, opening up new audiences for brands.

That said, there are notable differences in terms of generations, reactions from particular demographic groups (e.g., parents), and concerns about ads on these services that brands need to pay exceedingly close attention to. By taking advantage of these patterns, marketers have the opportunity to increase their differentiation and success in ad-supported streaming media.

We outline the results from portions of insights here; many more are available for download in our larger report.

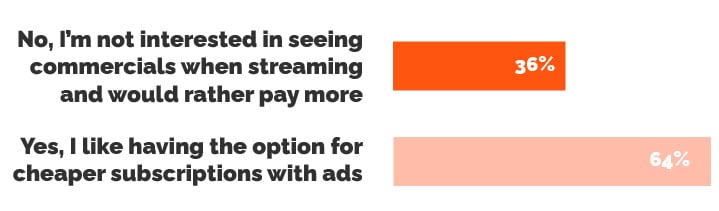

Overall, about two-thirds of consumers like the option of ad-supported tiers as a way to save money

Only 36% of consumers state that they do not support the option of ad-supported streaming. This number is fairly consistent across subscribers and non-subscribers of Netflix and Disney+.

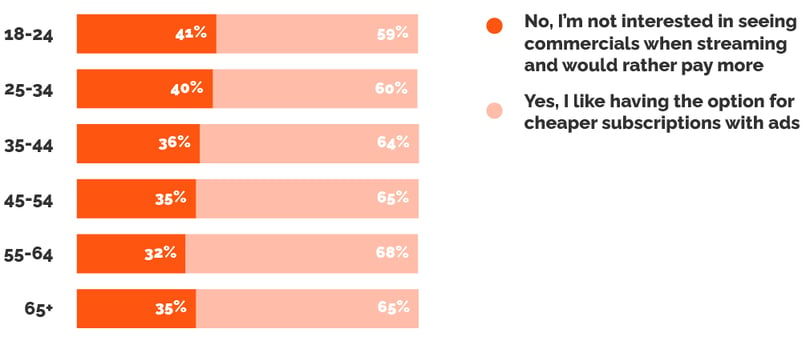

This proportion shifts slightly but notably across age; older consumers are more open than younger ones.

Another group who bucks this trend are expecting parents - who may be concerned about commercials for young children. 54% of that group are not interested in the option of ad-supported tiers.

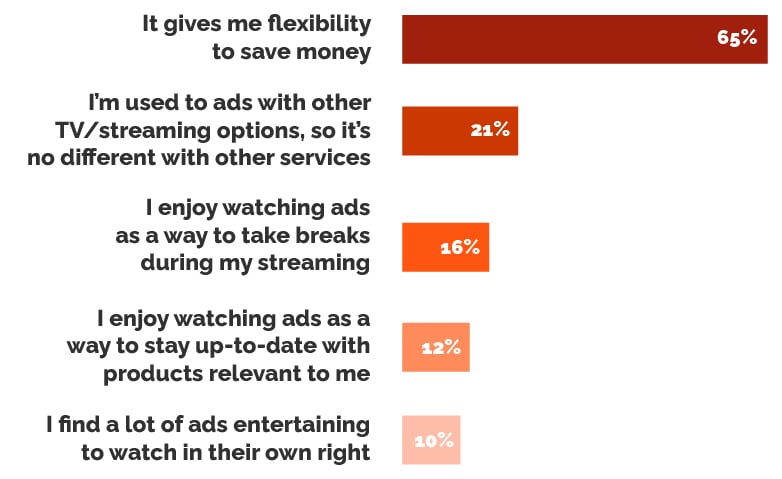

Flexibility is king in driving ad-supported tier interest. A minority are simply used to ads elsewhere, or find the ad content entertaining/topical

While challenging, winning on the relevance and/or entertainment factor of ads could be a huge way for brands to differentiate themselves in an increasingly-crowded ad-supported marketplace.

What are some of the reasons you would be interested in lower-cost ad-supported tiers of TV/video streaming services?

Although only a small minority of consumers truly enjoy ads, marketers and platforms can benefit from moving the needle here with new presentation and engagement methods. Whether this be via front-loading commercials, QR scanning to allow a period of ad-free programming, or otherwise, these new platform tiers offer the opportunity to test innovative ideas with customers.

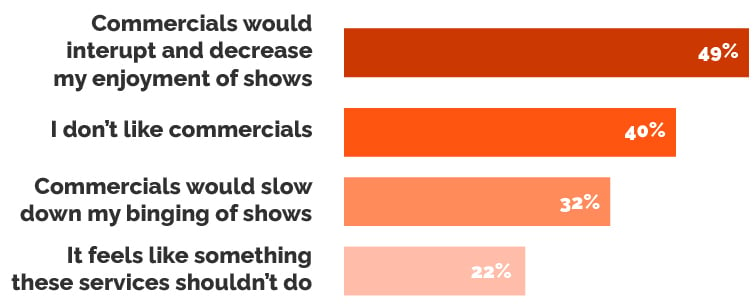

Among primary reasons to dislike ad-supported offerings, consumers predict that these ads will decrease show enjoyment or slow binging behavior, which could undermine overall platform satisfaction

Around one-third think ads will slow down binging behavior, but depending on the ad presentation method (e.g., blocked at beginning, etc.), this may be overblown.

What are some of the reasons you would not be interested in lower-cost ad-supported tiers of TV/video streaming services?

About one-fifth think brands should not offer ads out of principle. It follows that meaningful justification from these platforms, in messaging that resonates with consumers (e.g., recession), is likely to blunt potential adverse brand impacts.

There’s more where that came from

In our larger report, we dive deeper into the 30,000+ surveys we conducted with our members on ad-supported streaming. Topics covered include:

- Price sensitivity for ad-supported content

- Impacts of inflation on streaming spend vs. other categories

- YoY changes in openness to ad-supported streaming

- How new tiers from Netflix and Disney+ will impact subscribers

- Whether non-subscribers will be persuaded by new ad-supported models

Research Methodology

Through the DISQO CX platform, we ran two distinct surveys, leveraging over 35,000 members about their attitudes and opinions on TV streaming services.

In the first survey, we asked more than 27,000 people (n=27,436) September 24-25, 2022 about their attitudes about streaming services to understand how ad-supported models are received by consumers, and how Netflix and Disney+ services may be perceived upon launch. In the second survey, we asked more than 10,000 people (n=10,192) October 3-4, 2022 about their financial considerations around TV streaming services, with a particular focus on price sensitivity, changes in spending, and concerns around inflation.

All survey data is weighted to be nationally representative among the US population on age, gender, and household income.

About DISQO

DISQO is the place to go when you need to know. We start with a direct relationship with willing consumers who share all of their digital behaviors and opinions. The DISQO CX platform allows brands to understand the entire consumer journey by linking what they say with what they do. The 100% opted-in DISQO audience voluntarily shares zero-party data about themselves – both their attitudes and what they actually do online – allowing brands to create competitive advantages with unparalleled knowledge.

With DISQO, companies in every sector can understand their audiences, stay ahead of trends, and make business decisions confidently. DISQO is recognized in Deloitte’s Fast 500 and is a Top 100 Next Gen Workplace. Follow DISQO on LinkedIn and Twitter.

Our products and services include:

- Market research audience services

- API-supported survey research

- Quick-turn agile research tools

- Ad and message testing

- Ad effectiveness measurement

Subscribe now!

Get our new reports, case studies, podcasts, articles and events