Walmart and Target still strive to match Amazon’s Prime Day success

Amazon Prime Day is now an established commercial holiday, joining Black Friday, Cyber Monday, and other annual events where consumers and consumerism are celebrated.

Occurring just as the United States appeared to be emerging from the dark days of the pandemic, this year’s event was closely watched by the press and certainly by its competitors, who worked to blunt its impact by offering overlapping deal days.

Amazon Prime Day offered “2 million deals available for Prime members in 20 countries” — spanning a two-day period, Monday and Tuesday, June 21 and 22.

In the United States, Target and Walmart tried to beat the dominant online retailer to the punch, starting their discount windows a day earlier than Amazon on Sunday, June 20th. Target’s “Deal Days” ran through June 22nd, while Walmart’s “Deals for Days” extended an extra day to June 23rd.

How did Amazon, Target and Walmart fare in their overlapping attempts to woo US consumers?

We used behavioral data from the DISQO Audience, 1.3 million opted-in adults in the United States, to observe more than 700,000 online store visits to these retailers between June 13 and 26, to understand the behaviors of consumers and the differences in online shopping habits across different demographics.

Deal Days Provide Site Lift, But Amazon Still Outperforms Target and Walmart

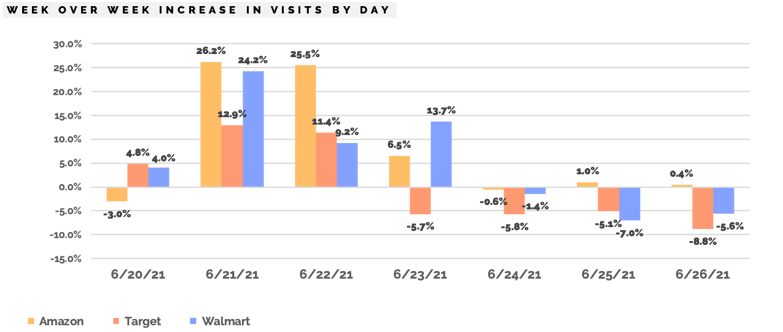

Target and Walmart started their deal days on Sunday, the day before Amazon initiated Prime Day, and each Amazon competitor received a slight lift in visits on Sunday compared to the same day in the previous week as a result (4.8% and 4.0%, respectively). Visits to Amazon were down on Sunday, as customers anticipated Amazon’s upcoming sale.

Visits to all three sites increased markedly on Amazon Prime Day, June 21 and 22.

On the first day of Prime Day, Walmart came close to Amazon’s lift (24.2% vs 26.2%). Target showed about half the lift (12.9% week-over-week). Monday was the peak day for all three retailers, but Walmart’s visits declined the most on Tuesday.

On Tuesday, Amazon maintained their lift at 25.5%, but Target had dropped to 11.4% and Walmart had been cut by more than half to 9.2%.

By Wednesday, Amazon had ended their sales, but Walmart’s continued, driving a 13.7% lift in visitation versus the prior week. Amazon pulled out a nice 6.5% lift despite their lack of deals, while Target’s traffic dropped below their level for the prior week, down -5.7%.

For Thursday to Saturday, when all the deals had ended, Amazon’s visits had returned to their week-earlier number, but both Target and Walmart experienced significant declines relative to their earlier visits. The net result was that for the week of Prime Day, Amazon’s visits were up 9.1%, Target’s were up 1%, and Walmart’s were up 5.4%.

Target and Walmart held their own against Amazon

Prime Day 2021 was a major success for Amazon. However, Target and Walmart managed to hold on to their customer traffic during the promotion. By running deal days concurrent with Amazon Prime Day, both Walmart and Target were able to piggyback on the interest in Amazon Prime Day to capture some consumer attention, promote comparison shopping, and drive increased site visitation.

Amazon’s traffic is 8.6 times that of Target, and 4.8 times that of Walmart, among DISQO panel members. So, Amazon is getting a much greater lift on a much bigger base.

If Target’s and Walmart’s goals are just to maintain traffic during a 48-hour period when their biggest competitor owns bargain-hunters’ mindshare, then they succeeded and probably gained a few customers.

Most of the shoppers were women at all stores, but especially at Target

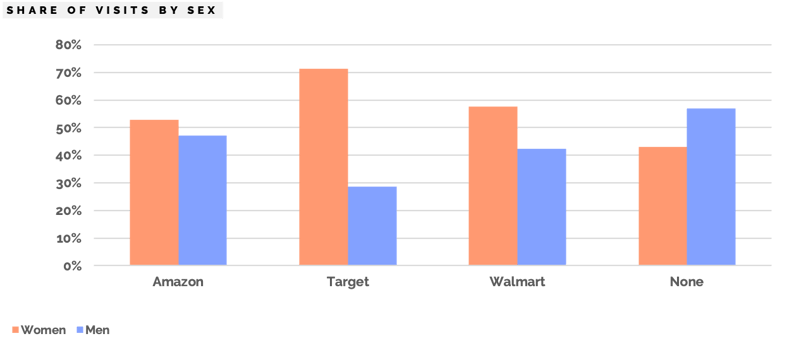

Women visited the three online retailers more often than men, and men accounted for 57% of those who didn’t visit any of the three sites between June 13 and 26.

Amazon had the most balanced audience, with 53% women. Target’s was the most lopsided, with nearly three-quarters of their visits coming from women.

Women preferred day 1, men preferred day 2

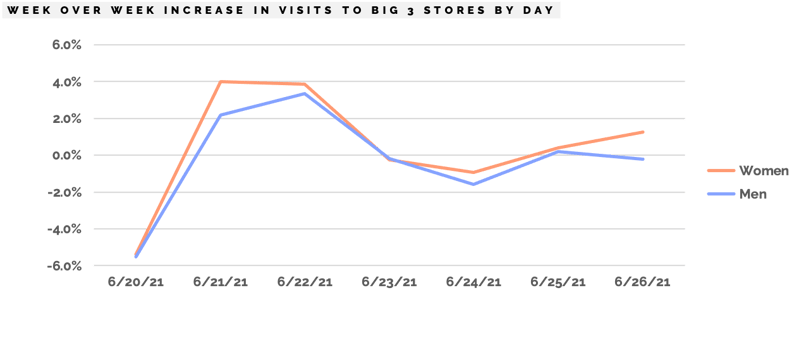

Although Target and Walmart began their deal days early, both men and women visited ecommerce sites less frequently (relative to the prior week) on the day before Prime Day began. And, while both sexes responded to deals from the three retailers during the two-day Prime Day period, women increased their visits most on the first day (up 4.0%), and men increased their visits more the second day (up 3.3%).

As the week wore on, both men and women dropped their visits to below the prior week on Wednesday, June 23. By Saturday, women were slightly up week-over-week and men had returned to their normal rate of visits to shopping sites.

Older Shoppers most responsive to Prime Day

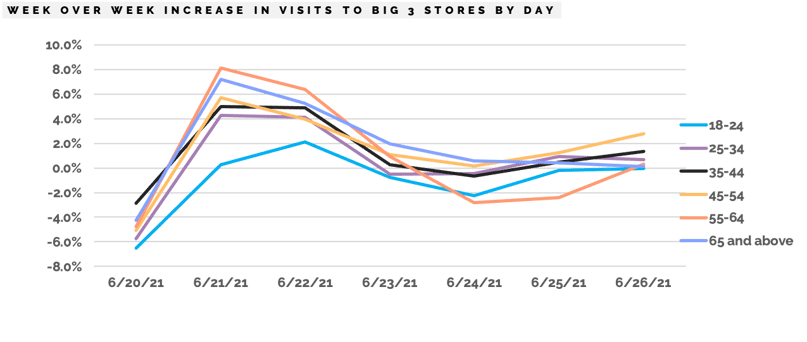

In a sign that consumers were holding tight to their wallet in advance of the deal days overlap, every age category displayed fewer overall site visits to the three online retailers in this study on the Sunday before Prime Day began.

Panel members aged 55-64 and those over 65 years-old increased their visits the most during Prime Day.

But every age group, except 18-24 year-olds, were up at least 4% relative to the previous week. The youngest adults increased their visits only slightly (up 2% on Tuesday).

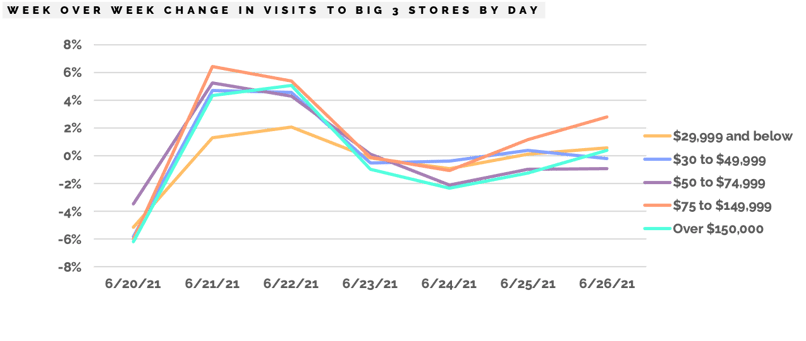

Prime Day is a middle-class holiday

Panel members in the middle and upper-middle household income groups were the most responsive to Prime Day.

Those members with household income between $30,000 and $150,000 responded the most, and either matched or exceeded their usual visits in the days that followed.

Members with incomes over $150,000 responded strongly, but dropped to lower-than-usual visit levels by Wednesday.

Lower income members barely increased their visits by 2% week-over-week. This echoes the 2% increase in visits for members aged 18-24 years old.

Understanding the Complexity of Consumer Retail

In 2015, Amazon pioneered the concept of online deal days for US and European consumers with the launch of Prime Day.

Just as Prime Day mimicked Chinese retailer Alibaba’s successful “Singles Day” promotions begun in 2009, Amazon’s US-based competitors have taken a copycat approach to Amazon by launching their own, overlapping deal days.

Unlike Amazon, Target and Walmart are each able to extend their deals to their brick and mortar retail footprint. In the online world, Amazon continues to dominate in terms of visitors and visits. But Amazon’s competitors have decided that they won’t cede the battle for consumer attention during Prime Day — now two days! — and consumers have responded by lifting visits to all three retailers during the overlapping deal period.

The battle for retail consumers is only increasing in complexity. In 2020, Walmart launched Walmart+, a subscription competitor to Amazon Prime, and Amazon expanded its brick and mortar ambitions. In such a dynamic environment, direct insight into actual consumer behavior is an essential tool for retailers and investors to understand consumer tactics and strategies.

Subscribe now!

Get our new reports, case studies, podcasts, articles and events